Activities

We assist Brazilian “emerging-growth” companies with their capital needs.

Kennedy Partners maintains relationships with a broad range of investors and private investment capital providers in Brazil and the U.S. These include Investment Banks, Pension Funds, Insurance Companies, Private Equity and Hedge Funds, Family Offices, and Wealth Management Groups.

With our relationships and in-depth knowledge of the private capital marketplace, we bring senior level advice and timely execution to companies seeking capital.

We have no pre-set limits on the minimum amount of capital we are prepared to raise. We have a track record of creating innovative investment structures and raising funds in the “non-traditional” places, as well as in the “traditional” places, and even under adverse market conditions.

- We conduct Private Placements by raising up to US$2 million for “early-stage” businesses.

- We conduct Financial Advisory in corporate finance, corporate planning and global capital markets.

- We conduct Merchant Banking by assuming an operational role in the companies that we invest in and continue to raise them “growth” capital.

PRIVATE PLACEMENTS

We specialize in raising “risk capital” for emerging-growth companies.

Our Private Placements are offered to an investor base that is accustomed to taking additional risks in order to receive returns significantly above alternative market investments.

Our investor base principally includes high net worth individuals, “angel” investors, family offices, “small-cap” oriented debt and equity funds, as well as large global reaching financial institutions, such as hedge funds, commercial banks and insurance companies.

- We raise Growth Capital in private placements with individual investors usually structured as either Long- term “Mezzanine Debt” or Short-term “Bridge Loans.” In both structures our investor will receive a securitized loan and an ‘equity kicker” in the business.

- We raise Venture Capital in private placements with individual investors for “early-stage” companies usually structured as Venture Debt. We also conduct First and Second Round Venture Equity raises placed with Private Equity funds and Family Offices.

Private Placements

A Private Placement in the financial markets is when a Financial Advisor assists a company raise private investment capital. Private investment capital is money invested into a company by an investor in the form of stock, debt, or some combination thereof. The benefits of a private placement are basically:

- High degree of flexibility in the amount of financing, which can range from $100,000 upwards in the security (debt or equity) being issued.

- Upfront costs are lower than closing with a private equity firm or selling the company´s securities in a U.S. Registered or Un-Registered Offering.

- Quicker capital raising in comparison with both a private equity fund and in a Public Offering.

Growth Capital

Long-term – We raise Mezzanine Debt Capital in private placements for companies planning to expand rapidly from a solid base of business. The Debt is usually repaid over 3 years, priced reasonably above the prevailing market rate, and combined with an “equity kicker”, either in the form of conversion rights into voting stock or by issuing stock purchase warrants.

Short-term – We raise “Bridge” or “Project” Loans in private placements for companies having specific working capital needs. The Loan is usually repaid within 18 months, priced reasonably above the prevailing market rate, and combined with an “equity kicker”, either in the form of conversion rights into voting stock, the issuance of stock purchase warrants, or sometimes free stock.

Track Record / Long-term

Intercontinental Telecom Corporation do Brasil Ltda.

US$ 12 million

Convertible Debt

September 2001

Resource Holdings, Inc.

US$ 11.4 million

Profit Sharing Notes and Shares

October 2011

Eucalis Comercial de Madeiras Ltda.

US$ 262,500

Secured Notes and Shares

September 2014 – February 2015

Track Record / Short-term

Alcana Destilaria de Álcool de Nanuque S/A

R$ 2.0 million (USD 400,000)

Crop Financing Notes

April 2005

Comanche Clean Energy Corporation

US$ 375,000

(for Fondelec Capital Advisors)

March 2007

BioClean Energy S/A

R$ 1.5 million (US$ 917,000)

IPO Bridge Loan & Warrants

June - September 2011

Venture Capital

Equity – We raise “First Round Capital” for early-stage and start-up businesses. Given that the investor market here is comprised of highly experienced investors, such as “angels” and venture capital funds, we do not we do not raise this capital via a structured private placement. Instead our investment terms are negotiated between the parties.

Debt/Equity – We raise “Second Round Capital” usually in private placements for early-stage businesses. Given that these businesses can generate cash flows quicker than start-ups, we raise venture debt structured as a Secured Promissory Note priced reasonably above the prevailing market rate and combined with an “equity kicker” by either granting free corporate stock or issuing stock purchase warrants.

Track Record / Equity

Track Record / Debt-Equity

MasterLink Automação e Segurança Ltda.

US$ 100,000

Project Financing Notes

November 2004

Resource Holdings, Inc.

$1.5 million

Secured Notes & Shares

December 2009 - September 2011

Eucalis Comercial de Madeiras Ltda.

R$ 305,000 (US$ 87,500)

Bridge Loan & Shares

July 2015

FINANCIAL ADVISORY

We have decades of financial advisory experience with “emerging growth” companies.

Historically very few Brazilian “emerging growth” companies have raised capital in the global capital markets. However, we have a successful track record in assisting these smaller Brazilian companies raise both equity and debt in the global capital markets.

- We provide advisory expertise on the Global Capital Markets by arranging or placing up to US$100 million in debt or equity capital.

- We provide advisory expertise on Corporate Finance by leading a corporate merger, acquisition, sale mandate, joint venture, including the sale of corporate assets.

- We provide advisory expertise on Corporate Planning by conducting Valuations and Fairness Opinions, recommending financing alternatives and optimal capital structures, and pre-IPO preparations, such as choosing the right U.S. underwriter.

GLOBAL CAPITAL MARKETS

Private Debt – We arrange and place Long-term Debt with a vast network of lenders including US commercial banks, private finance companies, hedge funds, family offices and other alternative lenders We can provide debt capital up to 10 years for as low as 10% p.a. for a specific project given it has assets and cash flows that receive a single A credit rating from a global insurance company. Here we set-up this special purpose financing vehicle as a captive self-insurance company and know how to get the single A credit rating.

Private Equity – We arrange and place private equity capital with global-oriented investors such as U.S. and European Private Equity Funds, Hedge Funds, Family Offices and U.S. FINRA Private Placements We can assist your company, whether it is privately held or publicly traded (thru a ¨PIPE¨ - Private Investment in Public Equity), with a direct private offering of securities to a limited number of sophisticated investors in order to raise capital. These retail and institutional investors can include hedge funds, pension funds, insurance companies, stock funds, trust and high net worth private clients.

Public Equity – We advise and arrange public equity capital with U.S. investment banks that specialize in “micro-cap” and “small-cap” IPOs (“Initial Public Offerings”) and APOs (“Alternative Public Offerings”). We have launched a new and innovative NASDAQ FAST-TRAK IPO Program to provide these companies an alternative to multi-stage venture capital (VC) and private equity (PE) funding. Our program helps early-stage companies successfully complete an IPO at a better valuation than typical capital raised from traditional VC and PE funds.

An APO is when a privately-held company raises public equity capital through a PIPE with a publicly-listed “shell company” in a simultaneous merger, a so-called Reverse Take-Over (“RTO”). We subsequently work with the new publicly-listed company get their stock trading in the U.S. capital markets.

Track Record / Private Debt

Vitech America Inc.

US$ 100 million

Global Note Facility (TAC Notes)

April 1998

Special Opportunities Investments Corp.

US$ 13.9 million

TAC Note Purchases

2000 – 2001

Intercontinental Telecom Corporation do Brasil Ltda.

US$ 12 million

Convertible Debt

September 2001

CTF Technologies Inc.

US$ 15 million

Convertible Debt Private Placement

June 2007

Track Record / Private Equity

Intercontinental Telecom Corporation do Brasil Ltda.

US$ 20 million

Convertible Preferred Equity

May 2000

Resource Holdings, Inc.

US$ 11.4 million

Profit Sharing Notes and Shares

October 2011

P.I.P.E. ("Private Investment in Public Equity")

A PIPE is a “Private Investment into a Public Equity” because a privately-held company raises capital privately by issuing an equity stake to qualified investors via a newly-formed publicly-registered company that replaces the privately-held one. The equity stake can be in the form of common or preferred stock, convertible bonds, or a long-term loan with warrants.

The privately-held company can issue public equity in its newly-formed company it created as its substitute by merging with a “shell” company (non-operating) that is publicly-reporting on the OTC stock market. This merger is often called a “Reverse Take Over” (RTO) because the privately-held company is taken-over by the publicly-reporting shell company. Given that this “shell company” is just that, a publicly-registered corporate shell with no operations, the privately-held company maintains in total control of the publicly-traded company after the RTO. Thus a PIPE transaction strategically positions the privately-held company to access an abundance of capital via the stock market.

PIPE transactions make-up a trillion US dollar global investor pool. PIPEs are either Registered Offerings (see APO) for usually large companies or Un-Registered Offerings (see APO) for usually small companies. An Un-Registered offering is basically exempt from filing an SEC registration statement, which is a very detailed and comprehensive securities application that allows a company to sell its shares on US stock markets. Designed to assist the “small-cap” company sell their shares in raising capital on the stock markets, an Un-Registered PIPE offering, which is also called a Reg. D or Reg. A Offering, is a quick and cheaper way to raise capital on the US stock markets.

Registered or Un-Registered Public Offerings

Un-Registered Offerings

- An Un-Registered Offering is conducted on the OTC Bulletin Board.

- These PIPEs usually raise between US$5 and US$30 million, but the median is $1 million since the minimum is $100,000.

- Since these Reg. D and Reg. A offerings are usually smaller than Registered Offerings, investors here are accredited individuals, family offices, and accredited investor clients of “small- cap” brokerage firms.

Registered Offerings

- A Registered Offering is conducted on “Listed” stock markets (i.e.: AMEX and NASDAQ and NYSE).

- These PIPEs raise at least US$30 million in either IPOs or APOs.

- Since an IPO or APO sells “Registered Stock” and in large amounts compared with an Un-Registered offering, the global financial institution is now a major investment player along with accredited individual investors, and family offices.

Track Record / Public Equity

Vitech America Inc.

US$ 12 million

(LOI for U.S. Initial Public Offering)

January 1995

Vitech America Inc.

US$ 22 million

U.S. Initial Public Offering

November 1996

Intercontinental Telecom Corporation do Brasil Ltda.

US$ 50 million (LOI)

U.S. Initial Public Offering

September 2000

BioClean Energy S/A

US$ 25 million (LOI)

U.S. Initial Public Offering

April 2011

I.P.O. (“Initial Public Offering”)

An Initial Public Offering—or IPO as its most commonly called—is the process by which a company goes from being privately-owned to being owned also by the general public when it sells equity shares or stock in their company in return for capital.

Why does a company go public? It's simply a money-making move. The basic idea is to raise funds and have the ability to access cash by selling their stock publicly. The IPO money is usually either re-invested in the company or used to expand its businesses, with the sole intent on creating a higher value for the company´s stockholders. An added benefit from issuing stock is that shares can be used to attract top management candidates through the offer of non-cash perks like stock option plans. Going public also allows the company´s stock to be used in merger and acquisition deals as part of the payment in lieu of cash.

There's also the IPO prestige, and bragging rights for some, of being listed on a stock exchange.

So what are the basic key steps in an IPO? The company seeking an IPO hires an investment bank initially to advise and eventually to handle the IPO. The technical process of handling an IPO is called an underwriting because the investment bank literally buys (“underwrites”) the stock of the private company before the bank can offer the company´s stock for the first time to the general public. Hence it´s an Initial Public Offering. To conduct an IPO the private company must have a financial audit completed according to the US SEC´s rules, as well as file an application with the SEC, called an S-1, for it to sell legally sell its stock to the US general public.

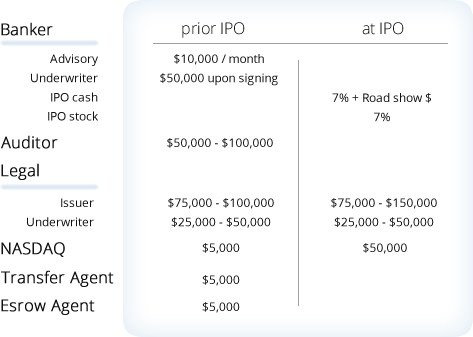

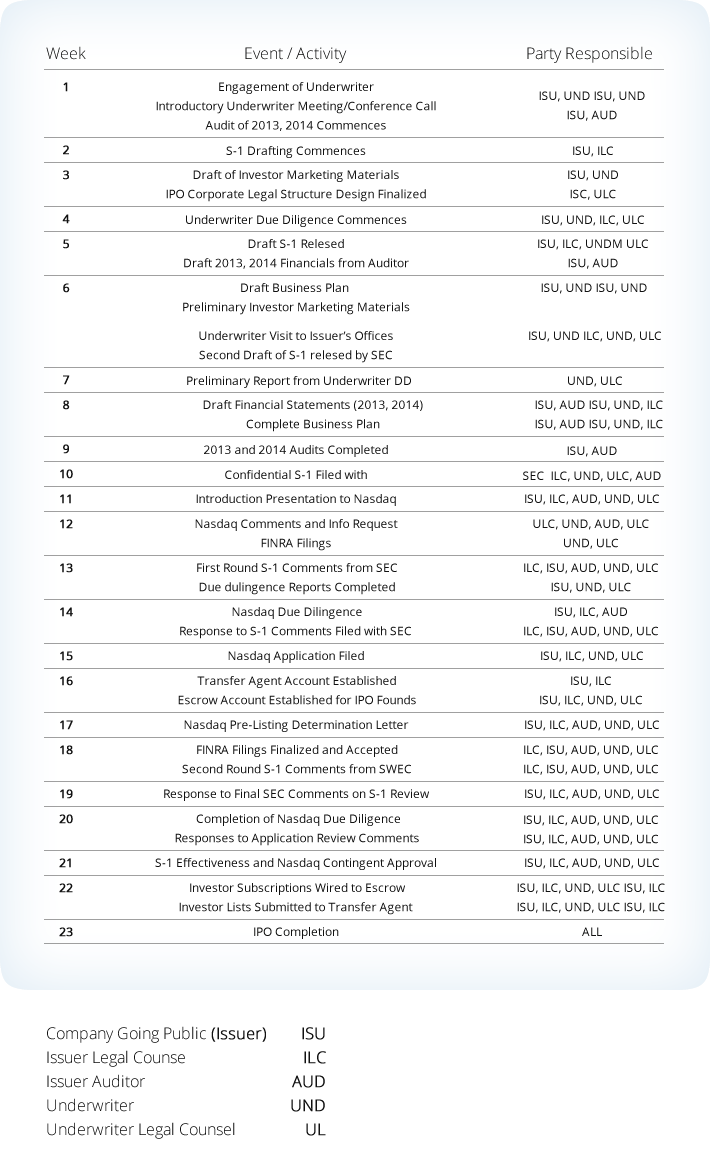

Kennedy Partners has decades of experience in advising companies conduct IPOs. To assist evaluate going public you can review Summary of IPO Costs and IPO Activities and Timeline as well as consider our NASDAQ FAST-TRAK IPO Program.

A.P.O. (“Alternative Public Offerings”)

An APO is when a privately-held company raises capital via the US stock market in a private placement or PIPE.

A PIPE is a “Private Investment into a Public Equity” because a privately-held company raises capital privately by issuing an equity stake to qualified investors via a newly-formed publicly-registered company that replaces the privately-held one. The equity stake can be in the form of common or preferred stock, convertible bonds, or a long-term loan with warrants.

An APO can be realized when the privately-held company merges itself with a “public shell” company (non-operating) that is publicly-reporting on the OTC stock market. This merger is often called a “Reverse Take Over” (RTO) because the privately-held company is taken-over by the publicly-reporting shell company. Given that this “shell company” is just that, a publicly-registered corporate shell with no operations, the privately-held company maintains in total control of the publicly-traded company after the RTO. Thus a PIPE transaction strategically positions the privately-held company to access an abundance of capital via the stock market.

And the APO has nearly all of the benefits as an IPO (Initial Public Offering)

APOs can be conducted as either Registered or Un-Registered Public Offerings.

NASDAQ FAST-TRAK IPO Program

For this IPO Program we seek client companies that are poised for rapid and explosive growth, have the ability to meet NASDAQ listing requirements and have a business model that public market investors are interested in.

Our program “packages” a company for public ownership and prepares them to raise “bridge” capital to finance: (1) the private-to-public transition, (2) the cost to complete all necessary legal, accounting, underwriting and regulatory requirements of an IPO, and (3) to pre-sell the IPO to ensure that the registered offering will be successfully completed.

The Program is designed to provide the following:

- Assist a client Company in completing all necessary steps to acquire capital from investors for a pre-IPO debt or equity financing that will fund the approximately 6-month $750K process of completing an IPO.

- Assist the Company in aligning the right service providers and project managing everything from beginning-to-end for successful pre-IPO and IPO offerings.

- Assist the Company and Underwriter in identifying sources of capital that will have an interest in investing in a minimum $5mm IPO offering.

- Assist the Company in developing a comprehensive on-going after IPO investor awareness program that keeps investors interested in the company and its achievements.

So ask about learning more of our NASDAQ FAST-TRAK IPO Program.

Corporate Finance

Mergers, Acquisitions and Joint Ventures – We advise corporate buyers and sellers by conducting “strategic searches”, as well as negotiating, structuring and closing the strategic transaction.

Sale Mandate – We advise a single shareholder or a group of shareholders with the sale process and placement of their stock.

Asset Sales – We assist companies with a business divestiture as well as the sale of their corporate assets.

GLOBAL CAPITAL MARKETS

Vitech America, Inc. (Vitech)

Was created in 1994 as the US holding company of a Brazilian wholly-owned subsidiary, Bahia Tecnologia Ltda., that assembled and distributed computer equipment and related products throughout Brazil.

Vitech´s Challenge

In 1995, desiring to grow more rapidly, Vitech had identified and held negotiations to acquire several leading regional Brazilian computer distributors, but the Company lacked cash for acquisitions.

Kennedy´s Solution

Kennedy was retained to arrange “growth” capital alternatives. In February 1995 Kennedy presented to Vitech an IPO proposal from leading U.S. underwriter D.H. Blair & Co. With an IPO proposal in hand, Kennedy then raised $2 million in convertible debt in September 1995. In November Kennedy advised Vitech conduct a $22 million IPO with US broker HJ Myers. By 1998, IDC reported Vitech the #1 seller of computers in Brazil.

Kennedy´s Follow-on

Kennedy was retained by Vitech America, Inc. to advise on their acquisitions of Microtec Sistemas Indústria e Comércio S.A. (July 1997), Tech Stock Ltda. (October 1997), Tech Shop Ltda. and Rectech-Recife Tecnologia Ltda. (November 1997). The next year Kennedy was retained to structure a $100 million Medium-Term Global Financing Facility (April 1998). By the year-end Kennedy had raised $43.1 million in Global Notes.

GLOBAL CAPITAL MARKETS

Technology Acceptance Corporation (TAC)

was created in 1998 by Vitech America, Inc. as a Special Purpose Company under the laws of the Cayman Islands to raise capital for the Company in order to provide financing for their computer sales in Brazil.

Vitech´s Challenge

In 1997 Vitech America was fast becoming the leader in sales of personal computers in Brazil. To be competitive in the local PC market which then saw global leader Dell just enter Brazil, Vitech had to offer sales financing at competitive rates to its expanding customer base as it´s multinational competitors were doing, like HP, Dell, IBM and Itautec. Vitech did not have the financial resources.

Kennedy´s Solution

Kennedy was retained as Vitech´s financial advisor in January 1998 to explore with Brazilian banks the implementation of a global debt issuance facility. Within months Kennedy had commitments from Banco Fibra and Unibanco to structure TAC and distribute up to $100 million in global medium-term notes from an offshore facility. Kennedy structured TAC with Unibanco and Banco Fibra and then he raised $20 million in a first tranche that closed in April 1998. By the year-end Kennedy had raised $43.1 million in Global Notes.

Kennedy´s Follow-on

Kennedy was retained by Vitech in December 1999 to set-up an off-shore special purpose investment company to re-purchase defaulted TAC notes. Kennedy immediately set-up Special Opportunities Investments Corp. in the B.V.I. and raised $13.9 million which he used to negotiate the purchase of deeply discounted TAC notes.

GLOBAL CAPITAL MARKETS

CTF Technologies, Inc. (CTF)

is the market leader in providing comprehensive logistics and financial services to trucking fleet operators throughout Brazil.

CTF´s Challenge

In 2007 CTF had ambitious growth plans and was seeking long-term capital to launch several new capital intensive projects. CTF met with many local banks and private equity funds to raise this expansion capital, but all their capital requirements were too rigorous.

Kennedy´s Solution

Kennedy Partners was retained by CTF as a financial advisor in June 2007 to seek less onerous financing alternatives off-shore. With Kennedy´s network of contacts at US financial institutions, he sought those that specialize in raising convertible and mezzanine debt, which is notably much less expensive than Brazilian bank debt and less intrusive than private equity capital. Within months Kennedy got CTF several proposals from U.S. financial institutions on convertible debt with terms on the $15mm they were seeking.

Kennedy´s Follow-on

Kennedy Partners was retained by CTF in March 2008 to sell the company. In May 2008 he negotiated a sale for 100% of CTF to Endurance Capital Partners in Brazil.

BRIDGE LOAN

Alcana Destilaria de Álcool de Nanuque S/A (Alcana)

was a Brazilian privately-held company in the 1990s and 2000s that grew and cultivated sugar cane to be converted into hydrated alcohol and granulated sugar.

Alcana Challenge

During the 1990s, a majority of the Brazilian ethanol producers came under extreme financial hardship due to 1) low prices from an oversupply of ethanol, and 2) a lack of demand because of a small number of “multi-use” cars in circulation. By 2004 Alcana was practically bankrupt and couldn´t pay its field workers to plant their 2005 crop.

Kennedy´s Solution

Kennedy Partners was summoned by then partner WorldInvest in early 2005 to raise up to R$2 million for their client Alana. By April Kennedy had structured a loan that raised capital by pre-selling Alcana´s newly planted crop to Kennedy´s investors. With this capital, the Company was able to raise additional cash by further pre-selling of a larger crop and thus return to a profitable business. This allowed WorldInvest to sell Alcana to a foreign private equity fund by the end of 2005.

MERCHANT BANKING

Resource Holdings, Inc. (RHI)

was a US public-reporting company in early 2010 that had plans to invest or finance small-sized gold mining operations in Brazil.

RHI´s Challenge

In late 2009 RHI came to Brazil as a “start-up” and it needed capital for its initial operations, including market research and leg-work in uncovering and negotiating Brazilian investment opportunities.

Kennedy´s Solution

Kennedy Partners was retained by RHI as a financial advisor in November 2009 to raise seed capital and follow-on venture debt. Over the next year and a half Kennedy raised $1.5 million in venture capital until Kennedy closed on long-term funding of $11.4 million from Platinum West Ventures, LLC, part of U.S. hedge fund Centurion.

Kennedy´s Follow-on

Kennedy Partners was retained by RHI as Director of RHI´s Brazilian Subsidiary, Mineral-Parçeiros em Mineração Ltda., where he oversaw RHI´s investment in gold mining operations with Abdala Mineração Ltda. in Cuiaba, MT.

GLOBAL CAPITAL MARKETS

Resource Holdings, Inc. (RHI)

was a US public-reporting company in 2010 that had negotiated a financing with a small-sized gold mining operations in Brazil.

RHI´s Challenge

In June 2010 RHI had signed a Letter of Intent to provide $9.5 million in growth financing for Abdala Mineracao, a gold mining operation in Cuiaba, Brazil. Therefore RHI needed to raise at least that amount and more to pay for all the transaction´s closing costs.

Kennedy´s Solution

Kennedy Partners was retained by RHI in September 2010 to assist the company raise approximately $10 million to close the Abdala financing. By September 2011 Kennedy had assisted RHI and raised $11.4 million from Platinum West Ventures LLC (Centurion) in 3 year 15% secured notes plus an equity kicker of 15% of RHI´s voting shares.

Kennedy´s Follow-on

Kennedy Partners was retained by RHI as a financial advisor to conduct corporate finance advisory on their planned acquisitions and raise capital during 2011 to 2014. Subsequently, Kennedy raised $927,500 in sales of RHI common stock (2012) and raised $550,000 in two Bridge Loans (2013-14).

FINANCIAL ADVISORY

Intercontinental Telecom Corporation do Brasil Ltda. (ITC)

was created in 1998 with the “spin-off” of the IT department from Microtec Sistemas Indústria e Comércio S.A. ITC immediately became a fully-dedicated provider of wire-less broadband communications services to Microtec clients.

ITC´s Challenge

In 1999 ITC had plans for an aggressive growth strategy to implement its pioneering wireless broadband services in the many rapidly growing regional cities of Brazil.

Kennedy´s Solution

Kennedy Partners was retained by ITC as a financial advisor in December 1999 to raise private equity capital to fund this expansion plan. In May of 2000 Kennedy closed on $20 million in a private equity investment (at a $75 million pre-money valuation) from Caisse de Dépôt et Placement du Québec (CDPQ), a North American emerging markets private equity fund.

Kennedy´s Follow-on

Kennedy Partners was retained by ITC as a financial advisor in June 2000 to assist on closing numerous targeted acquisitions, including “Fairness Opinions” on their valuations during 2000 to 2002.

VENTURE CAPITAl

BioPetro Participações, S.A. (BioPetro)

was created in 2005 with the help of research at the University at Sao Carlos.

BioPetro´s Challenge

From 2006 to 2007 the founders of BioPetro had invested heavily and developed an innovative technology solution that would produce biodiesel at significantly below market costs while using a variety of raw materials. In 2008 they were seeking a significant amount of capital to build a biodiesel plant using their proprietary technology.

Kennedy´s Solution

Kennedy Partners was retained by BioPetro as a financial advisor in September 2008 to raise capital to construct their planned biodiesel plant. By June 2009 Kennedy had raised R$5 million from Brazilian private equity fund, Endurance Capital Partners (ECP), by merging BioPetro with ECP´s stalled biodiesel start-up, BioClean Energy S.A. (at a US$10 million pre-money valuation). By April 2010 BioPetro was producing biodiesel from their newly constructed plant.

Kennedy´s Follow-on

Kennedy Partners was retained by BioClean Energy S/A as a financial advisor in early 2011 to seek long-term capital for their rapid expansion plans. In April 2011 Kennedy negotiated a $25 million US Initial Public Offering proposal by Rodman & Renshaw, LLC.

MERCHANT BANKING

Eucalis Comercial de Madeiras Ltda. (Eucalis)

started its business and operations in August 2014, processing logs into sawn timber for sale to the wooden packaging industry.

Eucalis´ Challenge

In April 2014 Eucalis negotiated control of a family-run timber milling business that had ceased operating over several years. By August the mill was operating but the Company projected that it would need extra capital to modernize the plant and buy regular quantities of raw material in order to ramp-up sales in order to maximize its plant capacity utilization.

Kennedy´s Solution

Kennedy Partners invested along with “angel”capital of $200,000 in June 2014. Kennedy was retained by Eucalis in September 2014 to raise expansion capital, Kennedy raised $175,000 in the form of Units of $25,000 comprised of a 2 year secure promissory note and Eucalis shares.

Kennedy´s Follow-on

Kennedy Partners was retained by Eucalis in June 2015 to "turn-around" the company and raise expansion capital, of which John raised R$ 305,000 (USD 87,500) in Bridge Loans with individual investors. In 2016 when Eucalis was closed down, John negotiated with the majority owner of Eucalis to compensate investors with free shares in a newly created US investment company called Brazil Timber Corporation, which in August 2016 closed on the 100% acquisition of Agropecuária São Paulo Minas S.A. which contains approximately 4,000 hectares of forestry property in Minas Gerais state.

MERCHANT BANKING

Agrivest Americas, Inc. (AAI)

was a US public-reporting company that had plans in 2011 to 2014 to invest in small to medium-sized agricultural farming, mining and services companies in Brazil.

Agrivest´s Challenge

In late 2010 Agrivest came to Brazil as a start-up so it needed capital to pay for the research and leg-work in uncovering and negotiating Brazilian investment opportunities, including mining geologists, lawyers and everyday advisors.

Kennedy´s Solution

Kennedy Partners was retained by RHI as a financial advisor in November 2010 to raise seed capital. Over the ensuing years Kennedy raised $160,000 for the Company.

Kennedy´s Follow-on

Kennedy Partners was retained by AAI in April 2014 to conduct acquisition due diligence on Grupo Shalon S.A. Then in March of 2015 Kennedy Partners was retained to advise them on a merger, in fact a "Reverse Take-Over" (RTO), eventually closing with NXChain, Inc. (OTC.NXCN.QB) in December 2015.

FINANCIAL ADVISORY

CTF Technologies, Inc. (CTF)

is the market leader in providing comprehensive logistics, refueling and financial services to trucking fleet operators throughout Brazil.

CTF´s Challenge

In 2007 CTF´s majority shareholder and CEO wanted to sell 100% of CTF for personal reasons. After receiving purchase proposals from several Brazilian private equity funds, the CEO refused their offers mainly because of their onerous “cashing-out” restrictions on him.

Kennedy´s Solution

Kennedy Partners was summoned by CTF in March 2008 and retained as a financial advisor to seek buyers for the Company. In May Kennedy negotiated and closed an agreement for the sale of 100% of CTF to Endurance Capital Partners, a Brazilian private equity fund.

MERCHANT BANKING

Alta Floresta Gold, Ltd. (AFG)

is an established privately-held Canadian gold exploration company which owns 6 gold deposits in the “Juruena Belt” in Central Brazil.

AFG´s Challenge

In June 2014 AFG negotiated a management buy-out with ECI Exploration and Mining Inc. (ECI) for their ownership of Alta Floresta Mineracao Ltda. (AFM) in Brazil. From 2007 until 2013 ECI had invested up to $11 million in exploring these 6 gold deposits which resulted in the Cajueiro deposit attaining a NI 43-101 Resource Compliant Report indicating it had 470,000 ounces in gold reserves. However, AFG had very little capital available to build-out a gold mining plant for Cajueiro. In January 2015 AFG approached Kennedy Partners in discussions to raise the necessary capital to put Cajueiro into production.

Kennedy´s Solution

After months of site visits and tests, Kennedy proposed a financing via newly-created U.S. C-corporation that Kennedy would set-up, capitalize and make an investment into AFG. In July 2015 Kennedy signed an agreement to invest $2.3 million into AFG for a 41% equity stake and had a 2-year operator´s contract to supervise the development and operations at Cajueiro. In September Kennedy set-up Brazil Gold Corporation and raised $50,000 in Seed Capital while in parallel Kennedy sought to raise $2.5 million for the investment in AFG.

Mergers & Acquisitions

Kennedy Partners was retained by Vitech America, Inc. to advise on their acquisitions of Microtec Sistemas Indústria e Comércio S.A. (July 1997), Tech Stock Ltda. (October 1997), Tech Shop Ltda. and Rectech-Recife Tecnologia Ltda. (November 1997).

Corporate Strategy

Kennedy Partners was retained by AxisMed Gestão Preventiva da Saúde S/A to advise the CEO on strategic planning and raising growth capital, including a Management Buy-Out (June 2006). Kennedy Partners partnered with Adelphia Capital LLC of NYC to raise $3 million for the planned MBO (Management Buyout), but in November the AxisMed shareholders over-ruled it (October 2006).

Valuation

Kennedy was contracted by Worldinvest Empreendimentos, Consultoria e Participações Ltda. to conduct a corporate valuation as an independent third-party for their client Alliant Energy Holdings do Brasil Ltda. as part of a divestiture of their assets in Cataguazes Leopoldina S.A. on which Worldinvest was advising (November 2003).

Mergers & Acquisitions

Kennedy Partners was retained by Intercontinental Telecom Corporation do Brasil Ltda. (ITC) and advised on their acquisition of Masterlink Automação e Segurança Ltda. (June 2001).

Merchant Banking

Kennedy Partners created and raised $10.1million in capital for Millennium Investment Capital Corp., an investment company registered in the British Virgin Islands. Investments were made in both private and publicly-traded equities of Brazilian emerging-growth companies (2000-2001).

Financial Advisory

Kennedy Partners created and raised US$13.9 million in capital for Special Opportunities Investments Corp., an investment company registered in the British Virgin Islands. Investments were made in purchasing discounted TAC Notes from the receivables of Vitech America, Inc. (2000-2001).

Corporate Strategy

Kennedy Partners was retained by Plug & Use to structure a working capital facility and raise the capital to assist the company to continue grow rapidly. Kennedy Partners structured a “Supplier Financing Credit Facility” to raise R$500,000 (August 2005).

Merchant Banking / Sale Mandate

Kennedy Partners teamed with Beacon Rock Capital LLC in the U.S. to acquire RCR Representações e Serviços Ltda in early 2006, but was unsuccessful when Beacon unexpectedly pulled-out of the transaction. Kennedy Partners then teamed with Bulltick Capital Markets in a sale mandate for RCR (August 2006). RCR was later sold to a private investor group of Brazilian high net-worth investors.

Corporate Strategy

Kennedy Partners was retained by the new owners of SAQplast Indústria e Comércio S/A, Kennedy´s partners FondElec and Worldinvest, to raise expansion capital of R$1,500,000 for SAQplast Indústria e Comércio S/A (May 2005).

Corporate Strategy

Kennedy was called on by Worldinvest Empreendimentos, Consultoria e Participações Ltda. to manage their engagement with Fran´s Café Franchising Ltda., which included creating a strategic plan and raising equity capital with private equity funds and offshore strategic partners (September 2003).

Corporate Strategy

Kennedy was called on by Worldinvest Empreendimentos, Consultoria e Participações Ltda. to manage their engagement with Novopiso S.A., which included creating a strategic plan and raising equity capital with private equity funds and offshore strategic partners (February 2004).

Corporate Management

Kennedy was retained by American Private Equity Fund Manager, FondElec Capital Advisors LLC, to run and manage their group of 4 technology companies in Brazil, Octet Brasil S/A, Octet Participações Ltda., Octet Data Centers Ltda., and Octet Brasil Ltda. (December 2003). Over the following 7 years Kennedy supervised these 4 technology companies.

Corporate Strategy

Kennedy Partners was retained by Brazilian Fund Manager at Capitania S/A to advise the principals of their newly-formed private equity arm, Endurance Capital Partners S/A, with seeking, evaluating, and proposing venture capital and private equity investments (November 2007).

Capital Markets Advisory

Kennedy Partners was retained in June 2000 by Intercontinental Telecom Corporation do Brasil Ltda. (ITC) to advise on their IPO plans. In September 2000 Kennedy filed a U.S. S-1 for a $50 million U.S. Initial Public Offering led by investment bank Josepthal & Co.

Sale Mandate

After a number of attempts to acquire Brazilian agricultural companies in the State of Mato Grosso during 2012-2014, Kennedy was retained by AgriVest Americas Inc. in 2015 to assist management sell AAI´s “public shell” AGBR and return to its “Venture Capital” investors cash and stock through a merger via a RTO (“Reverse Take Over”) with a Fision Holdings, Inc. and then in October it was canceled for a RTO with NXChain Inc., OTC.NXCN.QB (December 2015).

IPO + Bridge Loan

Kennedy Partners was retained by BioClean Energy S.A. in April 2011 as their financial advisor to raise long-term “growth” capital. By May Kennedy had negotiated and closed a Letter of Intent for an IPO of $25 million on NASDAQ from leading US brokerage firm Rodman & Renshaw.

Given that BioClean would need additional working capital to “ramp-up” its operations and prepare for its upcoming IPO, Kennedy was contracted and raised R$1.5 million in a Bridge Loan to their upcoming IPO (June 2011).

Joint Venture

Kennedy Partners assisted Vitech America, Inc. negotiate a strategic partnership with U.S. giant computer company Gateway PLC, which included lending Vitech 3 year convertible debt of $23 million and providing a supplier line of credit of $11 million (August 1999).

Project Financing

Kennedy Partners was retained by Masterlink Automação e Segurança Ltda. to raise $100,000 in “project financing” for their security systems installation contract with Banco Bradesco S.A. (November 2004).

Mergers & Acquisitions

Kennedy Partners was retained by Intercontinental Telecom Corporation do Brasil Ltda. (ITC) to advise on their acquisition of Probit Tecnologia Educacional Ltda. (December 2000).

Mergers & Acquisitions

Kennedy Partners was retained by Intercontinental Telecom Corporation do Brasil Ltda. (ITC) to advise on their acquisition of Interactivo Consultoria e Desenvolvimento de Sistemas Ltda. (February 2000).

Corporate Management

Kennedy was retained by Intercontinental Telecom Corporation do Brasil Ltda. to manage the down-sizing and “turn-around” of the Company as their acting CFO, which included reducing payroll and selling assets while running the day-to-day operations of the Company (January 2001 – June 2003).

Fairness Opinion

Kennedy Partners retained by Intercontinental Telecom Corporation do Brasil Ltda. (ITC) to write a Fairness Opinion for ITC´s shareholders on the “fair-market-value” of the Company (September 2001).

Fairness Opinion

Kennedy Partners was retained by Intercontinental Telecom Corporation do Brasil Ltda. to conduct a “Fairness Opinion” on the Valuation in their acquisition of Masterlink Automação e Segurança Ltda. (February 2002).

Capital Markets Advisory

Kennedy Partners was retained by Intercontinental Telecom Corporation do Brasil Ltda. to assist in the negotiations with Fund Manager Caisse Dépôt of Quebec in raising an additional $12 million (September 2001).

Private Placement

Kennedy Partners was retained by Eucalis Comercial Madeiras Ltda. to raise R$305,000 in a Short-term Loan to finance their immediate expansion plans (July 2015).

Corporate Management

Kennedy Partners was retained by Eucalis Comercial Madeiras Ltda. to provide management and strategic oversight in their “turn-around” situation. (July 2015).

Corporate Management

Kennedy Partners was retained by OTC public company Ensurge to provide advisory services for its gold mining investment company´s operations in Brazil (February 2010). Kennedy structured and negotiated a multi-million dollar “Processing Equipment Rental Program” with a Brazilian gold mining operation in Cuiaba, Mato Grosso (May 2010).

Private Placement

Kennedy Partners was retained by Resource Holdings, Inc. (RHI) to raise capital through private sales of RHI shares. Over 6 months Kennedy Partners raised US$ 927,500 in total share sales (March to September 2012).

Private Placement

Kennedy Partners was retained by Resource Holdings, Inc. (RHI) in March 2013 to raise Bridge capital through an Un-Registered U.S. private placement in which he raise $415,000 through August 2013. Kennedy raised an additional US$ 135,000 in Units comprised of Notes and Common Share Warrants (December - February 2014).

Corporate Finance

Kennedy Partners was retained by AgriVest Americas, Inc. (AAI) to conduct due diligence and corporate finance advisory on AAI´s planned acquisition of Grupo Shalon in Mato Grosso, Brazil (April 2014).

Private Placement

Kennedy Partners assisted partner Fondelec Capital Advisors, LLC provide a Bridge Loan to Comanche Clean Energy to fulfill their acquisition and agreement with Ouro Verde Açúcar e Álcool Ltda. Shortly thereafter Comanche was capitalized with $81mm in a U.S. Registered private placement by brokerage firm Rodman & Renshaw LLC in order to complete the acquisition of Ouro Verde acquisition and two other clean-energy producing companies in Brazil (March 2007).

Private Placement

Kennedy Partners created Brazil Timber Corporation (BTC) in September 2015 as a US Delaware corporation to acquire forestry lands and timber milling operations in Brazil. Alongside Kennedy Partners´ initial investment in BTC, KP raised US$ 41,000 in seed capital from individual investors in October and November 2015. By June 2016 Kennedy had raised an additional US$ 85,700 in seed capital.

Mergers & Acquisitions

Kennedy Partners assisted Brazil Timber Corporation in the acquisition of 51% of Agropecuária São Paulo Minas S.A. in December 2015, and again assisted BTC purchase the remaining 49% of Agropecuária São Paulo Minas S.A. in August 2016.

Track Record / Mergers, Acquisitions and Joint Ventures

Vitech America Inc.

Acquisition of

Microtec Sistemas Indústria e Comércio S.A.

July 1997

Intercontinental Telecom Corporation do Brasil Ltda.

Acquisition of Interactivo Consultoria

e Desenvolvimento de Sistemas Ltda.

February 2000

Intercontinental Telecom Corporation do Brasil Ltda.

Acquisition of

Probit Tecnologia Educacional Ltda.

December 2000

Intercontinental Telecom Corporation do Brasil Ltda.

Acquisition of

MasterLink Automação e Segurança Ltda.

June 2001

AgriVest Americas, Inc.

Acquisition Due Diligence

(on Grupo Shalon S/A)

April 2014

Brazil Timber Corporation

Acquisition of 51% of

Agropecuária São Paulo Minas S.A.

December 2015

Brazil Timber Corporation

Acquisition of 100% of

Agropecuária São Paulo Minas S.A.

August 2016

Track Record / Sale Mandate

RCR Representações e Serviços Ltda.

Sale Mandate

(with Bulltick Capital Markets)

August 2006

CTF Technologies Inc.

Sale Mandate

(LOI with Endurance Capital Partners S/A)

May 2008

AgriVest Americas, Inc.

Merger (“Reverse Take Over”)

(NXChain Inc.: NXCN.QB)

March 2015

Track Record / Asset Sales

Intercontinental Telecom Corporation do Brasil Ltda.

Corporate Management

(Chief Financial Officer)

January 2001 – June 2003

CORPORATE PLANNING

Valuations – We prepare corporate Valuation Reports using the most appropriate valuation methodology. Depending on the client and valuation´s purpose, the valuation methodology used could be either “Comparable Company” multiples for a pre-IPO valuation or “Industry Transaction” multiples for private equity investment and a M&A; a “Discounted Cash Flow” methodology is predominantly used for project financings and start-up business plans.

Fairness Opinion – We opine on others´ corporate Valuation Reports which is often necessary in a shareholder vote, a legal action, among other circumstances.

Management – We lend our expertise in daily management in the areas of finance, sales & marketing and operations. We also assist management with "operational turnarounds" and with the recommendation and support of a shareholder majority.

Strategy – We research the competitive market place, develop business plans, arrange corporate transactions and propose their structures for any of the following activities: corporate equity and asset sales, investments, joint venture, private placement, venture capital raise, APO, PIPE, IPO, and leveraged buyout.

GLOBAL CAPITAL MARKETS

Vitech America, Inc. (Vitech)

Was created in 1994 as the US holding company of a Brazilian wholly-owned subsidiary, Bahia Tecnologia Ltda., that assembled and distributed computer equipment and related products throughout Brazil.

Vitech´s Challenge

In 1995, desiring to grow more rapidly, Vitech had identified and held negotiations to acquire several leading regional Brazilian computer distributors, but the Company lacked cash for acquisitions.

Kennedy´s Solution

Kennedy was retained to arrange “growth” capital alternatives. In February 1995 Kennedy presented to Vitech an IPO proposal from leading U.S. underwriter D.H. Blair & Co. With an IPO proposal in hand, Kennedy then raised $2 million in convertible debt in September 1995. In November Kennedy advised Vitech conduct a $22 million IPO with US broker HJ Myers. By 1998, IDC reported Vitech the #1 seller of computers in Brazil.

Kennedy´s Follow-on

Kennedy was retained by Vitech America, Inc. to advise on their acquisitions of Microtec Sistemas Indústria e Comércio S.A. (July 1997), Tech Stock Ltda. (October 1997), Tech Shop Ltda. and Rectech-Recife Tecnologia Ltda. (November 1997). The next year Kennedy was retained to structure a $100 million Medium-Term Global Financing Facility (April 1998). By the year-end Kennedy had raised $43.1 million in Global Notes.

GLOBAL CAPITAL MARKETS

Technology Acceptance Corporation (TAC)

was created in 1998 by Vitech America, Inc. as a Special Purpose Company under the laws of the Cayman Islands to raise capital for the Company in order to provide financing for their computer sales in Brazil.

Vitech´s Challenge

In 1997 Vitech America was fast becoming the leader in sales of personal computers in Brazil. To be competitive in the local PC market which then saw global leader Dell just enter Brazil, Vitech had to offer sales financing at competitive rates to its expanding customer base as it´s multinational competitors were doing, like HP, Dell, IBM and Itautec. Vitech did not have the financial resources.

Kennedy´s Solution

Kennedy was retained as Vitech´s financial advisor in January 1998 to explore with Brazilian banks the implementation of a global debt issuance facility. Within months Kennedy had commitments from Banco Fibra and Unibanco to structure TAC and distribute up to $100 million in global medium-term notes from an offshore facility. Kennedy structured TAC with Unibanco and Banco Fibra and then he raised $20 million in a first tranche that closed in April 1998. By the year-end Kennedy had raised $43.1 million in Global Notes.

Kennedy´s Follow-on

Kennedy was retained by Vitech in December 1999 to set-up an off-shore special purpose investment company to re-purchase defaulted TAC notes. Kennedy immediately set-up Special Opportunities Investments Corp. in the B.V.I. and raised $13.9 million which he used to negotiate the purchase of deeply discounted TAC notes.

GLOBAL CAPITAL MARKETS

CTF Technologies, Inc. (CTF)

is the market leader in providing comprehensive logistics and financial services to trucking fleet operators throughout Brazil.

CTF´s Challenge

In 2007 CTF had ambitious growth plans and was seeking long-term capital to launch several new capital intensive projects. CTF met with many local banks and private equity funds to raise this expansion capital, but all their capital requirements were too rigorous.

Kennedy´s Solution

Kennedy Partners was retained by CTF as a financial advisor in June 2007 to seek less onerous financing alternatives off-shore. With Kennedy´s network of contacts at US financial institutions, he sought those that specialize in raising convertible and mezzanine debt, which is notably much less expensive than Brazilian bank debt and less intrusive than private equity capital. Within months Kennedy got CTF several proposals from U.S. financial institutions on convertible debt with terms on the $15mm they were seeking.

Kennedy´s Follow-on

Kennedy Partners was retained by CTF in March 2008 to sell the company. In May 2008 he negotiated a sale for 100% of CTF to Endurance Capital Partners in Brazil.

BRIDGE LOAN

Alcana Destilaria de Álcool de Nanuque S/A (Alcana)

was a Brazilian privately-held company in the 1990s and 2000s that grew and cultivated sugar cane to be converted into hydrated alcohol and granulated sugar.

Alcana Challenge

During the 1990s, a majority of the Brazilian ethanol producers came under extreme financial hardship due to 1) low prices from an oversupply of ethanol, and 2) a lack of demand because of a small number of “multi-use” cars in circulation. By 2004 Alcana was practically bankrupt and couldn´t pay its field workers to plant their 2005 crop.

Kennedy´s Solution

Kennedy Partners was summoned by then partner WorldInvest in early 2005 to raise up to R$2 million for their client Alana. By April Kennedy had structured a loan that raised capital by pre-selling Alcana´s newly planted crop to Kennedy´s investors. With this capital, the Company was able to raise additional cash by further pre-selling of a larger crop and thus return to a profitable business. This allowed WorldInvest to sell Alcana to a foreign private equity fund by the end of 2005.

MERCHANT BANKING

Resource Holdings, Inc. (RHI)

was a US public-reporting company in early 2010 that had plans to invest or finance small-sized gold mining operations in Brazil.

RHI´s Challenge

In late 2009 RHI came to Brazil as a “start-up” and it needed capital for its initial operations, including market research and leg-work in uncovering and negotiating Brazilian investment opportunities.

Kennedy´s Solution

Kennedy Partners was retained by RHI as a financial advisor in November 2009 to raise seed capital and follow-on venture debt. Over the next year and a half Kennedy raised $1.5 million in venture capital until Kennedy closed on long-term funding of $11.4 million from Platinum West Ventures, LLC, part of U.S. hedge fund Centurion.

Kennedy´s Follow-on

Kennedy Partners was retained by RHI as Director of RHI´s Brazilian Subsidiary, Mineral-Parçeiros em Mineração Ltda., where he oversaw RHI´s investment in gold mining operations with Abdala Mineração Ltda. in Cuiaba, MT.

GLOBAL CAPITAL MARKETS

Resource Holdings, Inc. (RHI)

was a US public-reporting company in 2010 that had negotiated a financing with a small-sized gold mining operations in Brazil.

RHI´s Challenge

In June 2010 RHI had signed a Letter of Intent to provide $9.5 million in growth financing for Abdala Mineracao, a gold mining operation in Cuiaba, Brazil. Therefore RHI needed to raise at least that amount and more to pay for all the transaction´s closing costs.

Kennedy´s Solution

Kennedy Partners was retained by RHI in September 2010 to assist the company raise approximately $10 million to close the Abdala financing. By September 2011 Kennedy had assisted RHI and raised $11.4 million from Platinum West Ventures LLC (Centurion) in 3 year 15% secured notes plus an equity kicker of 15% of RHI´s voting shares.

Kennedy´s Follow-on

Kennedy Partners was retained by RHI as a financial advisor to conduct corporate finance advisory on their planned acquisitions and raise capital during 2011 to 2014. Subsequently, Kennedy raised $927,500 in sales of RHI common stock (2012) and raised $550,000 in two Bridge Loans (2013-14).

FINANCIAL ADVISORY

Intercontinental Telecom Corporation do Brasil Ltda. (ITC)

was created in 1998 with the “spin-off” of the IT department from Microtec Sistemas Indústria e Comércio S.A. ITC immediately became a fully-dedicated provider of wire-less broadband communications services to Microtec clients.

ITC´s Challenge

In 1999 ITC had plans for an aggressive growth strategy to implement its pioneering wireless broadband services in the many rapidly growing regional cities of Brazil.

Kennedy´s Solution

Kennedy Partners was retained by ITC as a financial advisor in December 1999 to raise private equity capital to fund this expansion plan. In May of 2000 Kennedy closed on $20 million in a private equity investment (at a $75 million pre-money valuation) from Caisse de Dépôt et Placement du Québec (CDPQ), a North American emerging markets private equity fund.

Kennedy´s Follow-on

Kennedy Partners was retained by ITC as a financial advisor in June 2000 to assist on closing numerous targeted acquisitions, including “Fairness Opinions” on their valuations during 2000 to 2002.

VENTURE CAPITAl

BioPetro Participações, S.A. (BioPetro)

was created in 2005 with the help of research at the University at Sao Carlos.

BioPetro´s Challenge

From 2006 to 2007 the founders of BioPetro had invested heavily and developed an innovative technology solution that would produce biodiesel at significantly below market costs while using a variety of raw materials. In 2008 they were seeking a significant amount of capital to build a biodiesel plant using their proprietary technology.

Kennedy´s Solution

Kennedy Partners was retained by BioPetro as a financial advisor in September 2008 to raise capital to construct their planned biodiesel plant. By June 2009 Kennedy had raised R$5 million from Brazilian private equity fund, Endurance Capital Partners (ECP), by merging BioPetro with ECP´s stalled biodiesel start-up, BioClean Energy S.A. (at a US$10 million pre-money valuation). By April 2010 BioPetro was producing biodiesel from their newly constructed plant.

Kennedy´s Follow-on

Kennedy Partners was retained by BioClean Energy S/A as a financial advisor in early 2011 to seek long-term capital for their rapid expansion plans. In April 2011 Kennedy negotiated a $25 million US Initial Public Offering proposal by Rodman & Renshaw, LLC.

MERCHANT BANKING

Eucalis Comercial de Madeiras Ltda. (Eucalis)

started its business and operations in August 2014, processing logs into sawn timber for sale to the wooden packaging industry.

Eucalis´ Challenge

In April 2014 Eucalis negotiated control of a family-run timber milling business that had ceased operating over several years. By August the mill was operating but the Company projected that it would need extra capital to modernize the plant and buy regular quantities of raw material in order to ramp-up sales in order to maximize its plant capacity utilization.

Kennedy´s Solution

Kennedy Partners invested along with “angel”capital of $200,000 in June 2014. Kennedy was retained by Eucalis in September 2014 to raise expansion capital, Kennedy raised $175,000 in the form of Units of $25,000 comprised of a 2 year secure promissory note and Eucalis shares.

Kennedy´s Follow-on

Kennedy Partners was retained by Eucalis in June 2015 to "turn-around" the company and raise expansion capital, of which John raised R$ 305,000 (USD 87,500) in Bridge Loans with individual investors. In 2016 when Eucalis was closed down, John negotiated with the majority owner of Eucalis to compensate investors with free shares in a newly created US investment company called Brazil Timber Corporation, which in August 2016 closed on the 100% acquisition of Agropecuária São Paulo Minas S.A. which contains approximately 4,000 hectares of forestry property in Minas Gerais state.

MERCHANT BANKING

Agrivest Americas, Inc. (AAI)

was a US public-reporting company that had plans in 2011 to 2014 to invest in small to medium-sized agricultural farming, mining and services companies in Brazil.

Agrivest´s Challenge

In late 2010 Agrivest came to Brazil as a start-up so it needed capital to pay for the research and leg-work in uncovering and negotiating Brazilian investment opportunities, including mining geologists, lawyers and everyday advisors.

Kennedy´s Solution

Kennedy Partners was retained by RHI as a financial advisor in November 2010 to raise seed capital. Over the ensuing years Kennedy raised $160,000 for the Company.

Kennedy´s Follow-on

Kennedy Partners was retained by AAI in April 2014 to conduct acquisition due diligence on Grupo Shalon S.A. Then in March of 2015 Kennedy Partners was retained to advise them on a merger, in fact a "Reverse Take-Over" (RTO), eventually closing with NXChain, Inc. (OTC.NXCN.QB) in December 2015.

FINANCIAL ADVISORY

CTF Technologies, Inc. (CTF)

is the market leader in providing comprehensive logistics, refueling and financial services to trucking fleet operators throughout Brazil.

CTF´s Challenge

In 2007 CTF´s majority shareholder and CEO wanted to sell 100% of CTF for personal reasons. After receiving purchase proposals from several Brazilian private equity funds, the CEO refused their offers mainly because of their onerous “cashing-out” restrictions on him.

Kennedy´s Solution

Kennedy Partners was summoned by CTF in March 2008 and retained as a financial advisor to seek buyers for the Company. In May Kennedy negotiated and closed an agreement for the sale of 100% of CTF to Endurance Capital Partners, a Brazilian private equity fund.

MERCHANT BANKING

Alta Floresta Gold, Ltd. (AFG)

is an established privately-held Canadian gold exploration company which owns 6 gold deposits in the “Juruena Belt” in Central Brazil.

AFG´s Challenge

In June 2014 AFG negotiated a management buy-out with ECI Exploration and Mining Inc. (ECI) for their ownership of Alta Floresta Mineracao Ltda. (AFM) in Brazil. From 2007 until 2013 ECI had invested up to $11 million in exploring these 6 gold deposits which resulted in the Cajueiro deposit attaining a NI 43-101 Resource Compliant Report indicating it had 470,000 ounces in gold reserves. However, AFG had very little capital available to build-out a gold mining plant for Cajueiro. In January 2015 AFG approached Kennedy Partners in discussions to raise the necessary capital to put Cajueiro into production.

Kennedy´s Solution

After months of site visits and tests, Kennedy proposed a financing via newly-created U.S. C-corporation that Kennedy would set-up, capitalize and make an investment into AFG. In July 2015 Kennedy signed an agreement to invest $2.3 million into AFG for a 41% equity stake and had a 2-year operator´s contract to supervise the development and operations at Cajueiro. In September Kennedy set-up Brazil Gold Corporation and raised $50,000 in Seed Capital while in parallel Kennedy sought to raise $2.5 million for the investment in AFG.

Mergers & Acquisitions

Kennedy Partners was retained by Vitech America, Inc. to advise on their acquisitions of Microtec Sistemas Indústria e Comércio S.A. (July 1997), Tech Stock Ltda. (October 1997), Tech Shop Ltda. and Rectech-Recife Tecnologia Ltda. (November 1997).

Corporate Strategy

Kennedy Partners was retained by AxisMed Gestão Preventiva da Saúde S/A to advise the CEO on strategic planning and raising growth capital, including a Management Buy-Out (June 2006). Kennedy Partners partnered with Adelphia Capital LLC of NYC to raise $3 million for the planned MBO (Management Buyout), but in November the AxisMed shareholders over-ruled it (October 2006).

Valuation

Kennedy was contracted by Worldinvest Empreendimentos, Consultoria e Participações Ltda. to conduct a corporate valuation as an independent third-party for their client Alliant Energy Holdings do Brasil Ltda. as part of a divestiture of their assets in Cataguazes Leopoldina S.A. on which Worldinvest was advising (November 2003).

Mergers & Acquisitions

Kennedy Partners was retained by Intercontinental Telecom Corporation do Brasil Ltda. (ITC) and advised on their acquisition of Masterlink Automação e Segurança Ltda. (June 2001).

Merchant Banking

Kennedy Partners created and raised $10.1million in capital for Millennium Investment Capital Corp., an investment company registered in the British Virgin Islands. Investments were made in both private and publicly-traded equities of Brazilian emerging-growth companies (2000-2001).

Financial Advisory

Kennedy Partners created and raised US$13.9 million in capital for Special Opportunities Investments Corp., an investment company registered in the British Virgin Islands. Investments were made in purchasing discounted TAC Notes from the receivables of Vitech America, Inc. (2000-2001).

Corporate Strategy

Kennedy Partners was retained by Plug & Use to structure a working capital facility and raise the capital to assist the company to continue grow rapidly. Kennedy Partners structured a “Supplier Financing Credit Facility” to raise R$500,000 (August 2005).

Merchant Banking / Sale Mandate

Kennedy Partners teamed with Beacon Rock Capital LLC in the U.S. to acquire RCR Representações e Serviços Ltda in early 2006, but was unsuccessful when Beacon unexpectedly pulled-out of the transaction. Kennedy Partners then teamed with Bulltick Capital Markets in a sale mandate for RCR (August 2006). RCR was later sold to a private investor group of Brazilian high net-worth investors.

Corporate Strategy

Kennedy Partners was retained by the new owners of SAQplast Indústria e Comércio S/A, Kennedy´s partners FondElec and Worldinvest, to raise expansion capital of R$1,500,000 for SAQplast Indústria e Comércio S/A (May 2005).

Corporate Strategy

Kennedy was called on by Worldinvest Empreendimentos, Consultoria e Participações Ltda. to manage their engagement with Fran´s Café Franchising Ltda., which included creating a strategic plan and raising equity capital with private equity funds and offshore strategic partners (September 2003).

Corporate Strategy

Kennedy was called on by Worldinvest Empreendimentos, Consultoria e Participações Ltda. to manage their engagement with Novopiso S.A., which included creating a strategic plan and raising equity capital with private equity funds and offshore strategic partners (February 2004).

Corporate Management

Kennedy was retained by American Private Equity Fund Manager, FondElec Capital Advisors LLC, to run and manage their group of 4 technology companies in Brazil, Octet Brasil S/A, Octet Participações Ltda., Octet Data Centers Ltda., and Octet Brasil Ltda. (December 2003). Over the following 7 years Kennedy supervised these 4 technology companies.

Corporate Strategy

Kennedy Partners was retained by Brazilian Fund Manager at Capitania S/A to advise the principals of their newly-formed private equity arm, Endurance Capital Partners S/A, with seeking, evaluating, and proposing venture capital and private equity investments (November 2007).

Capital Markets Advisory

Kennedy Partners was retained in June 2000 by Intercontinental Telecom Corporation do Brasil Ltda. (ITC) to advise on their IPO plans. In September 2000 Kennedy filed a U.S. S-1 for a $50 million U.S. Initial Public Offering led by investment bank Josepthal & Co.

Sale Mandate

After a number of attempts to acquire Brazilian agricultural companies in the State of Mato Grosso during 2012-2014, Kennedy was retained by AgriVest Americas Inc. in 2015 to assist management sell AAI´s “public shell” AGBR and return to its “Venture Capital” investors cash and stock through a merger via a RTO (“Reverse Take Over”) with a Fision Holdings, Inc. and then in October it was canceled for a RTO with NXChain Inc., OTC.NXCN.QB (December 2015).

IPO + Bridge Loan

Kennedy Partners was retained by BioClean Energy S.A. in April 2011 as their financial advisor to raise long-term “growth” capital. By May Kennedy had negotiated and closed a Letter of Intent for an IPO of $25 million on NASDAQ from leading US brokerage firm Rodman & Renshaw.

Given that BioClean would need additional working capital to “ramp-up” its operations and prepare for its upcoming IPO, Kennedy was contracted and raised R$1.5 million in a Bridge Loan to their upcoming IPO (June 2011).

Joint Venture

Kennedy Partners assisted Vitech America, Inc. negotiate a strategic partnership with U.S. giant computer company Gateway PLC, which included lending Vitech 3 year convertible debt of $23 million and providing a supplier line of credit of $11 million (August 1999).

Project Financing

Kennedy Partners was retained by Masterlink Automação e Segurança Ltda. to raise $100,000 in “project financing” for their security systems installation contract with Banco Bradesco S.A. (November 2004).

Mergers & Acquisitions

Kennedy Partners was retained by Intercontinental Telecom Corporation do Brasil Ltda. (ITC) to advise on their acquisition of Probit Tecnologia Educacional Ltda. (December 2000).

Mergers & Acquisitions

Kennedy Partners was retained by Intercontinental Telecom Corporation do Brasil Ltda. (ITC) to advise on their acquisition of Interactivo Consultoria e Desenvolvimento de Sistemas Ltda. (February 2000).

Corporate Management

Kennedy was retained by Intercontinental Telecom Corporation do Brasil Ltda. to manage the down-sizing and “turn-around” of the Company as their acting CFO, which included reducing payroll and selling assets while running the day-to-day operations of the Company (January 2001 – June 2003).

Fairness Opinion

Kennedy Partners retained by Intercontinental Telecom Corporation do Brasil Ltda. (ITC) to write a Fairness Opinion for ITC´s shareholders on the “fair-market-value” of the Company (September 2001).

Fairness Opinion

Kennedy Partners was retained by Intercontinental Telecom Corporation do Brasil Ltda. to conduct a “Fairness Opinion” on the Valuation in their acquisition of Masterlink Automação e Segurança Ltda. (February 2002).

Capital Markets Advisory

Kennedy Partners was retained by Intercontinental Telecom Corporation do Brasil Ltda. to assist in the negotiations with Fund Manager Caisse Dépôt of Quebec in raising an additional $12 million (September 2001).

Private Placement

Kennedy Partners was retained by Eucalis Comercial Madeiras Ltda. to raise R$305,000 in a Short-term Loan to finance their immediate expansion plans (July 2015).

Corporate Management

Kennedy Partners was retained by Eucalis Comercial Madeiras Ltda. to provide management and strategic oversight in their “turn-around” situation. (July 2015).

Corporate Management

Kennedy Partners was retained by OTC public company Ensurge to provide advisory services for its gold mining investment company´s operations in Brazil (February 2010). Kennedy structured and negotiated a multi-million dollar “Processing Equipment Rental Program” with a Brazilian gold mining operation in Cuiaba, Mato Grosso (May 2010).

Private Placement

Kennedy Partners was retained by Resource Holdings, Inc. (RHI) to raise capital through private sales of RHI shares. Over 6 months Kennedy Partners raised US$ 927,500 in total share sales (March to September 2012).

Private Placement

Kennedy Partners was retained by Resource Holdings, Inc. (RHI) in March 2013 to raise Bridge capital through an Un-Registered U.S. private placement in which he raise $415,000 through August 2013. Kennedy raised an additional US$ 135,000 in Units comprised of Notes and Common Share Warrants (December - February 2014).

Corporate Finance

Kennedy Partners was retained by AgriVest Americas, Inc. (AAI) to conduct due diligence and corporate finance advisory on AAI´s planned acquisition of Grupo Shalon in Mato Grosso, Brazil (April 2014).

Private Placement

Kennedy Partners assisted partner Fondelec Capital Advisors, LLC provide a Bridge Loan to Comanche Clean Energy to fulfill their acquisition and agreement with Ouro Verde Açúcar e Álcool Ltda. Shortly thereafter Comanche was capitalized with $81mm in a U.S. Registered private placement by brokerage firm Rodman & Renshaw LLC in order to complete the acquisition of Ouro Verde acquisition and two other clean-energy producing companies in Brazil (March 2007).

Private Placement

Kennedy Partners created Brazil Timber Corporation (BTC) in September 2015 as a US Delaware corporation to acquire forestry lands and timber milling operations in Brazil. Alongside Kennedy Partners´ initial investment in BTC, KP raised US$ 41,000 in seed capital from individual investors in October and November 2015. By June 2016 Kennedy had raised an additional US$ 85,700 in seed capital.

Mergers & Acquisitions

Kennedy Partners assisted Brazil Timber Corporation in the acquisition of 51% of Agropecuária São Paulo Minas S.A. in December 2015, and again assisted BTC purchase the remaining 49% of Agropecuária São Paulo Minas S.A. in August 2016.

Track Record / Valuations

Fran´s Café Ltda.

Valuation & Strategic Planning

(with Worldinvest)

September 2003

Alliant Energy International, Inc.

Valuation Analysis

(with Worldinvest)

November 2003

Track Record / Fairness Opinion

Intercontinental Telecom Corporation do Brasil Ltda.

Fairness Opinion

(ITC shareholders)

September 2001

Intercontinental Telecom Corporation do Brasil Ltda.

Fairness Opinion

(Masterlink acquisition)

February 2002

Track Record / Corporate Management

Intercontinental Telecom Corporation do Brasil Ltda.

Corporate Management

(Chief Financial Officer)

January 2001 – June 2003

Octet Brasil S.A.

Corporate Management

(Chief Operating Officer)

December 2003 – January 2010

Ensurge, Inc.

Brazilian Gold Mining

Management & Investments

February – June 2010

Eucalis Comercial de Madeiras Ltda.

Corporate Management

(Chief Operating Officer)

July - October 2015

Track Record / Strategy

Fran´s Café Ltda.

Valuation & Strategic Planning

(with Worldinvest)

September 2003

SAQplast Indústria e Comércio S/A

R$1.5 million (US$ 600,000)

Convertible Debt Private Placement

May 2005

Computer Warehouse Ltda. (“Plug Use”)

R$ 500,000 (US$ 200,000)

Credit Facility & Supplier Financing

August 2005

RCR Representações e Serviços Ltda.

Sale Mandate

(with Bulltick Capital Markets)

August 2006

Endurance Capital Partners S/A

Valuations, Private Equity &

Venture Capital Investments

November 2007 – March 2008

Merchant Banking

We invest in “Start-ups” to large “Leveraged Buyouts” with our investors.

We seek businesses in large and growing markets that are run by executives who exhibit “world-class” management practices and have produced impressive results. We strongly believe when “teamed” with these kinds of businessmen success will follow.

- We invest in “emerging-growth” companies, both their debt and equity securities, while raising them capital. We prefer established business with an immediate opportunity for rapid growth and near-term liquidity.

- We invest in “early-stage” companies while raising them capital. We believe that in picking the right “start-up” or identifying a successful “early-stage” business is an art, not a science. It mostly requires a sharply-honed and proven instinct for picking executives who are winners.

- We make “leveraged” acquisitions of businesses exhibiting accelerated growth potential that have a near-term exit for investors. We seek management-buyouts of companies and a corporate division within a large company that is planned to be “spun-off”.

Track Record / Emerging Growth

Millennium Investment Capital Corp.

US$ 10.1 million

Equity Investments

2000 – 2001

Eucalis Comercial de Madeiras Ltda.

US$ 262,500

Secured Notes and Shares

September 2014 – February 2015

Brazil Gold Corporation

LOI to purchase 41% equity stake

in Alta Floresta Gold Limited

July - September 2015

Track Record / Early Stage

Resource Holdings, Inc.

$1.5 million

Secured Notes & Shares

December 2009 – September 2011